Are disposable electronic cigarettes, popular overseas, about to be abandoned by Europe?

[Image Source: Pixabay]

Recently, Zhongwei Semiconductor, during a research session, stated that for MCU chips used in electronic cigarettes, the company has coordinated production capacity urgently, resulting in a gradual return of products and easing the shortage. Previously, Zhongwei Semiconductor faced a shortage due to high demand from electronic cigarette customers.

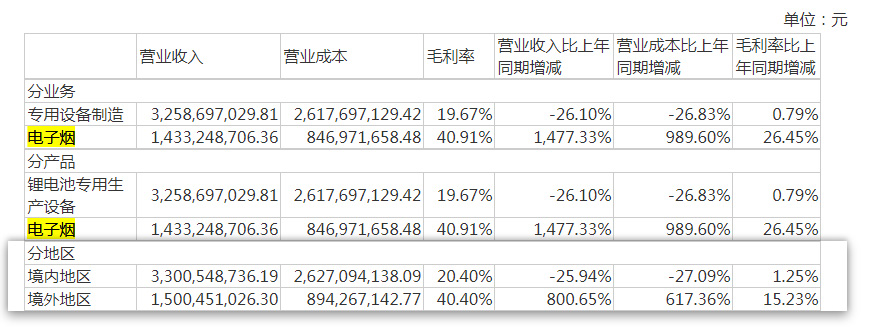

Zhongwei’s clients include the booming electronic cigarette brand Skol. Skol’s parent company, Yinghe Technology, reported revenue of 1.433 billion yuan in the first half of 2023, a year-on-year increase of 1477.33%, with a gross margin of 40.91%, up 26.45% year-on-year. Looking at the company as a whole, Yinghe Technology’s overseas revenue increased by 800.65% in the first half of the year, although overseas operating costs also increased by 617.36%, with net profit growing by over 80%.

[Image Source: Juchao Information]

However, this does not mean that the electronic cigarette industry is experiencing a new explosion. For example, top companies like Smoore International and RELX Technology saw significant declines in performance in the first half of the year. Data shows that Smoore International and RELX Technology’s net profits fell by 48.2% and 81.03% respectively in the first half of 2023.

In the third quarter of 2023, RELX Technology’s net revenue was 428.1 million yuan, down 59% year-on-year; under non-GAAP, net profit was 197.5 million yuan, a decrease of 39.92% year-on-year. Additionally, Wind data shows that in the first three quarters of this year, RELX Technology’s revenue and net profit fell by 80.07% and 81.03%, respectively.

Du Ying (Founder of ChillMist), founder of the electronic cigarette brand Qianmu, in an interview with Time Finance, stated that Skol’s performance growth benefitted from their popular disposable electronic cigarette products, but the disposable electronic cigarette market may soon face regulatory challenges.

Skol’s main markets are Europe and Southeast Asia. The UK government recently concluded a public consultation on teenage vaping, considering restrictions on the sale of disposable electronic cigarettes due to concerns about their environmental impact and influence on children. Additionally, in 2023, France, Germany, and Ireland have all taken measures to restrict the sale of disposable electronic cigarettes.

Time Finance contacted Skol regarding this year’s performance and overseas electronic cigarette policy environment, but did not receive a response before publication.

“Concerns about the harm of electronic cigarettes are gradually increasing, with policies like banning disposables and flavors already being considered by top decision-makers in Europe,” said Hou Yuhuan, Global Vice President of Shenzhen Liangzhi Technology Co., Ltd., in an interview with Time Finance.

Manufacturers face intense competition overseas, creating a highly competitive market.

MCU is a microprocessor chip widely used in consumer electronics, automotive electronics, and other scenarios.

“There is indeed a short-term shortage of MCU chips in the market,” observed Tan Zijun, an executive at Brandoo Biotechnology (Shenzhen) Co., Ltd.

He analyzed to Time Finance that this is mainly due to product upgrades. Since this year, the rapid and widespread application of screen display solutions and more intelligent digital animation screens in electronic cigarette products has made it difficult for the chip industry to keep up with and adapt to this pace of product upgrades. Rapid innovation and upgrades are also a distinctive feature of electronic cigarettes as a technologically-driven fast-moving consumer good.

Zhongwei Semiconductor also mentioned in the research that the shortage of MCU chips is due to an increase in the penetration rate of MCU in electronic cigarette solutions, and the proportion of electronic cigarette solutions using MCU has increased. This sudden demand, coupled with limited inventory from downstream distributors and customers, has exacerbated the shortage.

Overall, the global electronic cigarette market is still growing, but not explosively, and has become highly competitive.

Customs data shows that from January to November 2023, the total export value of electronic cigarettes and similar personal vaporizing devices was 18.789 billion yuan, a decrease of about 2% from the same period last year; during the same period, the total export value of other non-combustion nicotine-containing products was 51.316 billion yuan, an increase of about 29% year-on-year, including cartridges, e-liquids, and disposable electronic cigarettes.

Looking back further, a report by Everbright Securities shows that in 2022, global electronic cigarette sales amounted to 23.56 billion USD (about 1681.36 billion yuan), a 20% increase year-on-year, far exceeding the growth rate of traditional cigarettes and other categories. Among them, disposable electronic cigarettes accounted for 2.55 billion USD, nearly doubling year-on-year.

China is the world’s largest manufacturer and exporter of electronic cigarettes, with many manufacturers focusing on exports and OEM for overseas tobacco companies. In recent years, affected by various factors, electronic cigarette manufacturers have devoted more effort to overseas markets.

“The markets in the United States and the United Kingdom are now very competitive, and many are in a state of oversupply, where products are shipped first and payment is made upon sale,” said Du Ying. In such a situation, only differentiated brands can stand out.

She believes that given consumer demand, the global electronic cigarette market will maintain steady growth for at least the next decade, offering space for manufacturers to gradually establish brand recognition overseas. She also plans to lead her company in this effort.

“The common trait of successful companies in the past year has been a focus on brand cultivation and channel development,” observed Hou Yuhuan.

Policies and Laws Become Stricter

Disposable electronic cigarettes currently dominate the market overseas but may face a shift towards refillable products in the European market under current policies.

In June this year, ASH (Action on Smoking and Health), a public health charity established by the Royal College of Physicians in London, UK, released new data showing that in 2023, 69% of users most commonly used disposable electronic cigarettes, up from 52% in 2022 and 7.7% in 2021.

As the name suggests, unlike refillable electronic cigarettes, disposables cannot be refilled with e-liquid, have non-replaceable cartridges, and cannot be recharged for repeated use. A disposable electronic cigarette with a 2 ml e-liquid capacity typically allows for 600-800 puffs.

“The UK now has too many disposables, and it’s becoming an environmental issue,” Du Ying predicts, estimating that the UK is likely to introduce regulatory policies restricting disposable electronic cigarettes next year.

She explained that disposables are popular due to their convenience and lower purchase cost compared to refillables. As the number of disposables with large puff counts increases, the price per milliliter becomes even cheaper, further popularizing disposables.

However, she also believes that with the increasing global awareness of environmental protection, the disposable electronic cigarette market might be impacted by regulations, and in the future, they may gradually be replaced by eco-friendlier refillable products.

It’s important to note that restricting disposables does not equate to a blanket ban on electronic cigarettes. Hou Yuhuan noted that the UK’s stance on electronic cigarettes remains positive, with the government advocating for smokers to switch from traditional cigarettes to electronic ones as part of its goal to become a “smoke-free country” by 2030.

The “2021 Electronic Cigarette Industry Blue Book” published by the China Electronic Chamber of Commerce Electronic Cigarette Industry Committee and Juanjuan Think Tank shows that in 2021, China’s electronic cigarette industry export totaled 138.3 billion yuan, with 65% coming from disposables. Geographically, over 80% of exports went to the US, EU, Russia, and the UK.

In addition to the UK, countries like France and the USA are also tightening policies and laws on disposable electronic cigarettes.

Recently, foreign media reported that the French parliament unanimously voted to ban disposable electronic cigarettes, with the bill still requiring approval from the French Senate and the European Commission.

As a major consumer of electronic cigarettes, the US Food and Drug Administration (FDA) has banned all flavors for refillable electronic cigarettes except menthol and tobacco. While they have not made a clear statement on disposables, they have issued multiple warnings to brands and retailers.

Will Chinese manufacturers lose the European and American electronic cigarette markets? A manager from an e-liquid manufacturing company told Time Finance, “It won’t affect [the market],” as China has a definitive advantage in electronic cigarette manufacturing, and it’s difficult for European countries to completely ban disposable electronic cigarettes due to their high penetration rate.

Source: https://www.tfcaijing.com/article/page/6a7949356d45576e4d5970662b413054426b4a7231413d3d